news

Decentralized Finance explained. What is DeFi?

Decentralized Finance

What is DeFi?

DeFi is short for decentralized finance and refers to an all-inclusive ecosystem of applications, financial services, and other financial infrastructures that operate within the key principles of privacy, transparency, neutrality, and sovereignty. DeFi tools are openly accessible and operate utilizing blockchain technology, and it will be a game-changer for the financial world and the global economy as we know it.

Decentralized finance includes a wide spectrum including digital assets, smart contracts, dApps which are built on blockchain technology. Considering the amount of development and flexibility involved, the Ethereum platform is currently the foremost choice for DeFi applications; however, it is not the only one.

Imagine an open financial system in which financial tools and services can be built in a decentralized manner. Since these applications are always built utilizing blockchain technology, the data can easily be verified.

With the use of decentralized technology like smart contracts, DeFi has led to the elimination of middlemen, which have long plagued finance unnecessarily. This has created favorable situations where:

- One can get access to instant loans without the need for paperwork sans any bank approval.

- One can earn real interest with their assets without the need to sacrifice them due to the prevailing low-interest rates.

- Quick issuance of company stocks without the need for banks to intervene thereby saving one from exorbitant bank fees.

History of Bitcoin & DeFi

DeFi, or decentralized finance, originated from blockchain technology.

Bitcoin, which most people have at least heard of by now, was the forefather of Defi. Bitcoin was created by an individual or a team of individuals under the pseudonym of Satoshi Nakamoto in 2009 as a peer to peer electronic cash system. Peer to peer in this instance meaning that individuals can transact with one another directly, user to user, without a trusted third party.

Bitcoin was created in response to the bank bailouts after the 2008 financial crisis and a time where major banks were accused of rampant fraudulent activities. It emerged like the phoenix out of the ashes and provided hope for a new way of life that many citizens of this world so longed for. This innovative and exciting notion laid the foundation of a decentralized, censorship-resistant, and open and transparent platform, with the intent of replacing or strengthening the traditional system of value exchange.

The emergence of DeFi

Bitcoin is the first major and successful public blockchain and it is still the most popular and largest in terms of market capitalization. Yet over ten years after its invention, thousands of projects have been rolled out under the same guiding principles of decentralization. Bitcoin being open-source has allowed developers around the world to contribute to the community and create similar projects. The new currencies that emerged after, based on either blockchain or similar technologies, are known as cryptocurrencies that thrive on the ideologies of DeFi.

Consider the situation of a laborer who doesn’t own any bank account who has his daughter working in the US. Under the current remittance system, the fee alone overcharges the funds she sends by 7%. This apart, the laborer has no access to financial markets for making any investments. Inflation can eat away at his income over time, as he is unable to earn any interest over it.

Decenttralized Finance (DeFi) enters the building.

Today, with the implementation of DeFi, the laborer can not only enjoy a larger portion of the funds due to lower fees, but an app on his smartphone allows him to invest a certain amount to generate a return on his savings.

The top financial leaders of the country have been holding on to their indomitable positions for long. But with glaring inequalities of these global financial systems in the wake of economic meltdowns, the dominance of the traditional financial system is waning.

With this pattern emerging in almost every region of the world, many crypto startups have risen like a phoenix with divergent sets of ideas, and with one principal intention: to ensure that financial services are accessible to everyone on a global scale. The adoption of Blockchain technology in finance is reshaping the existing ecosystem into a new world which is what we call Decentralized Finance or DeFi. With DeFi, not only finance is accessible to everyone, but it is also characterized by a relatively lower transaction price and security.

Let’s take a closer look a how DeFi measures up with traditional finance.

How DeFi scores over Traditional Finance

The best part about DeFi is the autonomy, which will in the coming years overthrow the central control exercised by governments and larger enterprises. DeFi certainly scores over Traditional finance, we tell you how:

- Irrespective of who creates, administers, and manages any DeFi service, there is complete transparency in its operations.

- Users have 100% control and access to their money. Custody is not in the hands of any financial institution like a bank.

- There are no geographical boundaries restructuring you, neither is there a dependence on verifying, again and again, your identity to manage digital assets. For those 1.7 million unbanked people, DeFi facilitates access to money with absolute control of money by its users.

- At the center of its operations, DeFi is not controlled by any institutions. The major role played is by the algorithms which are written in code or through smart contracts. After deploying smart contract DeFi apps can run without any human intervention.

- Lastly, DeFi comes with the power of code transparency making it possible for anyone to audit. This develops trust and the transactions being pseudonymous, questions about privacy are unlikely to emerge.

Many have pointed out that DeFi is just another form of ‘Open Finance’ which has been a matter of debate ever since it came into being.

The benefits of DeFi

In the quest to shape the global financial system, DeFi offers myriad benefits.

- DeFi is a disruptive concept that aims to tear apart the concept of status wealth. It enables wider global access to financial services. It intends to eliminate the barriers that prevent global access to financial instruments.

- The cross border payments are affordable because the role of intermediaries has been eviscerated.

- There is little doubt that DeFi provides superior security and unmeasured privacy. Centralized institutions are vulnerable to breaches. DeFi does not have any single centralized source of failure for any breaches to occur.

- Decentralized Finance also offers censorship-resistant transactions. The DeFi system brings the required stability and is a pefect option for those countries which are reeling under the rule of corrupt governments and leaders.

- In terms of becoming more mainstream, developers of DeFi applications are incessantly focussing on creating a seamless, integrated, transparent, and intuitive user experiences so that the full advantages of DeFi can become apparent to the mass general pubic

While each of the benefits is powerful in their own right, a combination of these can bring profound implications.

The Future of Decentralized Finance

DeFi is powered to change the world economy. It will enable the unbanked to join the rest of the world and become a part of the economic system thereby accelerating new investment opportunities. All the challenging areas in the financial system like loans and remittance is easily addressed by DeFi.

By removing inaccuracies, middlemen, and centralized control, DeFi is without a doubt the future of the entire financial sector and will transform the global economy.

DeFiRev.com is #1 in DeFi News. Check back in soon to find out the latest in DeFi News.

Make sure to check out more DeFiRev articles and sign up for our exclusive newsletter + get access to VIP DeFi Networking here.

DeFiRev.com – HOME

news

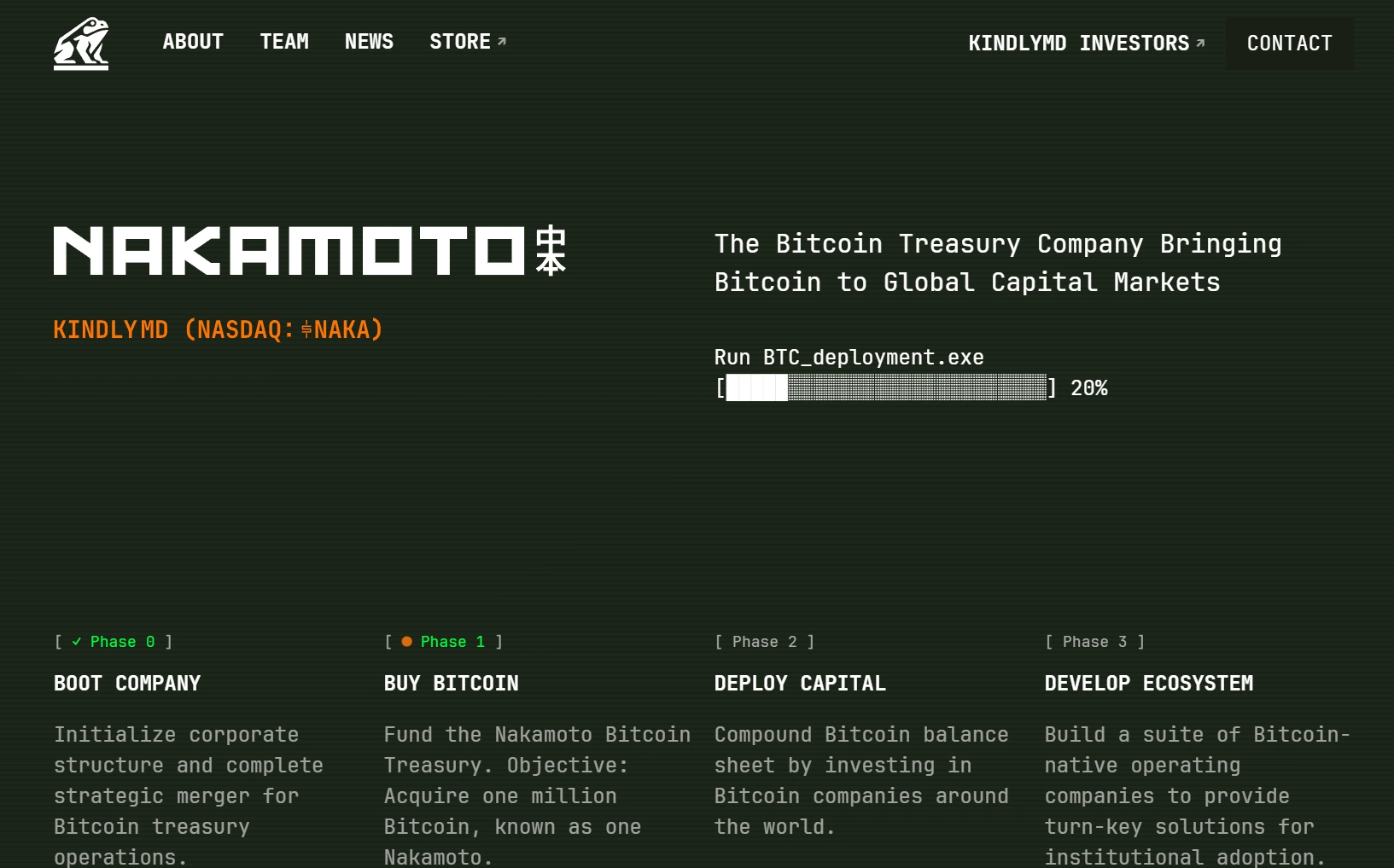

David Bailey’s Nakamoto creates Bitcoin Treasury with KindlyMD

David Bailey’s Bitcoin Treasury comes to life

On August 14, 2025, KindlyMD, Inc. (NASDAQ: NAKA) finalized its merger with Nakamoto Holdings Inc., a Bitcoin-native holding company, marking a bold step toward establishing a publicly traded Bitcoin treasury vehicle. The combined entity, retaining the KindlyMD name, will trade on the Nasdaq Capital Market under the ticker “NAKA,” with Nakamoto operating as a wholly-owned subsidiary focused on Bitcoin financial services. The merger, backed by $540 million in private placement (PIPE) financing and an anticipated $200 million convertible note offering, aims to fund significant Bitcoin acquisitions and drive global adoption.

David Bailey, Nakamoto’s founder and the combined company’s CEO, envisions a future where Bitcoin anchors global capital markets. “Since my journey in Bitcoin began 13 years ago, I’ve believed it will become the most valuable asset in history,” Bailey stated. The company’s ambitious goal is to acquire one million Bitcoin, leveraging innovative financial strategies to integrate the cryptocurrency into corporate and government treasuries.Bailey revealed his plan in a post on X (formerly Twitter) on Monday, writing:

$762M Allocation to Acquire 6,400 BTC

The $762.5 million allocation, rounded up in Bailey’s statement, will be used to acquire roughly 6,400 BTC at current market prices of about $118,892 per coin. The purchase will be executed using a Volume Weighted Average Price (VWAP) strategy to minimize slippage and avoid market disruption, rather than a straight market buy.

Building a $1B Bitcoin Treasury

This move is part of Bailey’s broader $1 billion Bitcoin accumulation goal, allowing Nakamoto to join the ranks of major corporate holders like MicroStrategy and Metaplanet. Following its merger with Nasdaq-listed KindlyMD earlier this year, Nakamoto has gained access to significant capital resources, having previously secured $710 million to fuel its Bitcoin treasury expansion.

Expanding Influence in the Bitcoin Space

Bailey, who also co-founded Bitcoin Magazine’s parent company BTC Inc., has described his vision as building a “Bitcoin juggernaut” that will become one of the largest holders in the world. He also took to X recently to signal his plans to raise up to $200 million for a political action committee to advance Bitcoin’s interests in the United States.

Corporate Bitcoin Holdings Continue to Rise

Nakamoto’s purchase comes amid a surge in corporate Bitcoin acquisitions, with over 1.24 million BTC now held by public and private companies worldwide, showing Bitcoin’s growing presence in institutional portfolios.

news

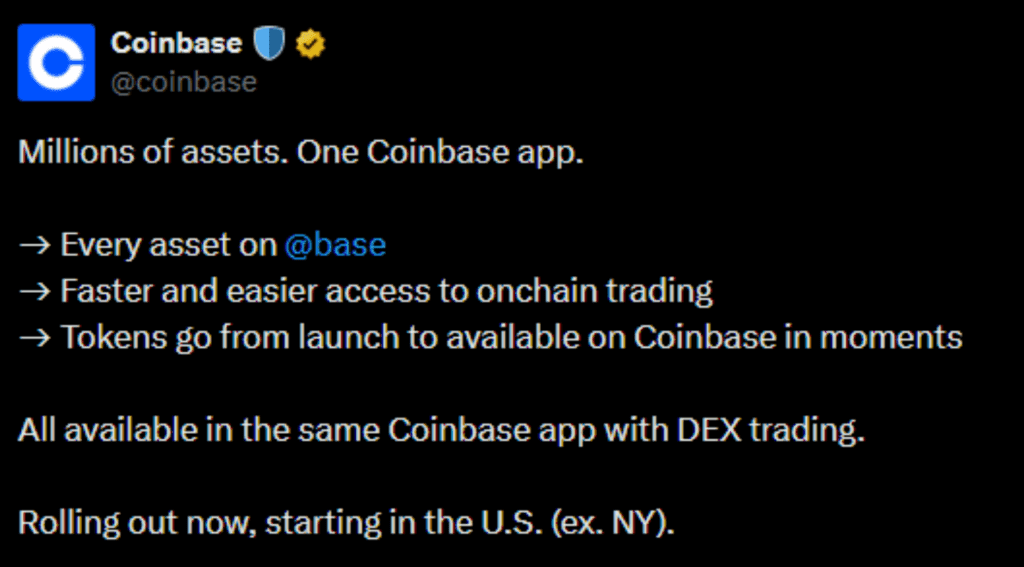

Coinbase DEX launches for the first time ever

Coinbase DEX has rolled out decentralized exchange (DEX) trading directly inside its app, giving users access to millions of onchain assets without leaving the platform. The launch is live for U.S. users outside New York State and runs on Coinbase’s Ethereum Layer 2 network, Base.

The feature introduces an integrated self-custody wallet, letting traders buy, sell, and manage tokens from the same interface they already use. Moreover, Coinbase is covering all network fees at launch, removing one of the main barriers to decentralized trading.

Faster Access to Onchain Markets

With the new Coinbase DEX integration, users can trade tokens within moments of their creation on Base. The initial rollout includes Base-native assets from projects like Virtuals AI Agents, Reserve Protocol DTFs, SoSo Value Indices, Auki Labs, and Super Champs. Support for new assets will be added in batches to maintain stable performance.

Trades are routed through Coinbase DEX aggregators that scan platforms like Aerodrome and Uniswap to secure the best available prices. Market data and risk insights are pulled directly from onchain sources, with Coinbase blocking access to tokens flagged as malicious by third-party security partners.

“A new era of access, going from just 300 assets yesterday to millions before long.” -Coinbase

Expansion Beyond Base

Coinbase plans to expand DEX trading to more networks, starting with Solana, and eventually to more countries. This move combines centralized convenience with decentralized freedom, offering portfolio management, fiat integration, and instant access to emerging tokens.

The company is positioning the update as part of its “everything exchange” vision, aiming to merge traditional listings with rapid onchain access. For traders and builders, this could mean faster entry to markets and a larger audience from day one.

news

Circle to Launch ARC Layer 1

USDC issuer Circle has announced plans to launch its own open Layer-1 blockchain, Arc, later this year. The network is designed specifically for stablecoin payments, foreign exchange, and capital markets, a move the company calls “the next era of stablecoin-native applications.” The announcement was made on August 12 through Circle’s official blog and X post:

Arc will be EVM-compatible and use USDC as its native gas token. This allows users to pay predictable, dollar-denominated transaction fees without holding volatile crypto assets. Other features include a built-in FX engine, deterministic sub-second settlement finality, and opt-in privacy controls.

Circle says Arc will be fully integrated across its platform and remain interoperable with the 24 blockchains already supporting USDC. The blockchain will run on Malachite, a high-performance consensus engine acquired from Informal Systems, and its core software will be released under an open-source license.

Based on their announcement, use cases for Arc range from cross-border payments and stablecoin FX markets to tokenized assets and on-chain credit systems. Circle aims to give developers and institutions a unified foundation to build stablecoin-powered applications at scale.

Arc will enter private testnet in the coming weeks, with a public testnet expected this fall and mainnet beta in 2026. As Circle put it, Arc is intended to be “the home for all forms of digital money and tokenized value,” bridging enterprise needs with the openness of public blockchain infrastructure.

-

news2 years ago

news2 years agoPayPal Crypto Bound! PayPal is betting on bitcoin and DeFi in a BIG way.

-

trading2 years ago

trading2 years agoInjective Protocol, the new Binance IEO, packs a punch

-

trading2 years ago

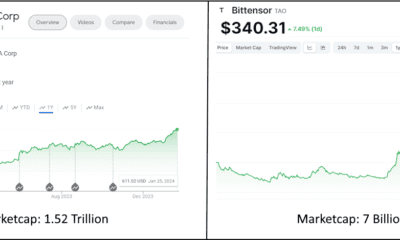

trading2 years agoBittensor booms as Chip Mania hits Stock Market: The AI Race and the Potential of TAO

-

trading2 years ago

trading2 years agoUniSwap Heating up BIG TIME! Is this the end of IEOs? New DeFi Projects fundraising on Uniswap.

-

interviews2 years ago

interviews2 years agoBobby Ong CoinGecko CEO: Interview with the Trailblazing Entrepreneur

-

trading5 years ago

trading5 years agoWhat is Solana? How SOL is aiming to solve scaling issues.

-

trading2 years ago

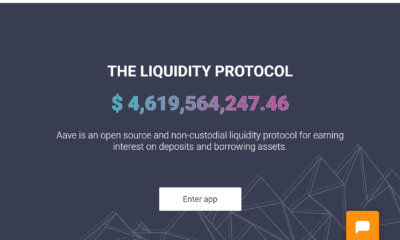

trading2 years agoAAVE CRYPTO ASSET SOARING

-

trading5 years ago

trading5 years agoLitecoin MimbleWimble Update -Privacy upgrade to push fungibility with Mimblewimble on Extension Blocks