latestnews

DeFi Yield Farming: You’ve seen the term everywhere. Here’s what it is.

What is Yield Farming?

Yield Farming is essentially the act of users putting in their own funds to provide liquidity to the various DeFi protocols to “farm” the best “yield” which is in the form of native tokens for the respective protocol, thus earning additional capital.

DeFi Yield Farming — The insignia of DeFi

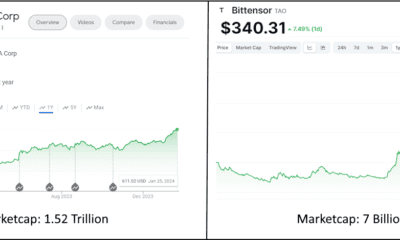

DeFi is an umbrella term referring to the interrelatedness of different crypto assets, Decentralized apps, smart contracts, and protocols, most of which are built on the Ethereum blockchain platform. The Decentralized finance (DeFi) ecosystem is one of the fastest-growing sectors that continues to attract new users and investments, with the current value within the DeFi ecosystem being close to touching $1.52 billion.

Whereas Bitcoin allowed individuals to make transactions without the need of an intermediary, the Ethereum blockchain added another layer of programmability with the use of smart contracts. Now, the DeFi vision integrates the concept of the decentralized financial system with the offerings of traditional products but without any central authority.

Recently DeFi Pulse announced that Compound was the largest DeFi protocol because a multitude of traders are migrating to Compound to farm COMP. Compound is now the largest application in terms of the DeFi value locked into the protocol.

Yield Farming and DeFi

Yield Farming is not a brand new concept but it surely has received a lot of attention this year.

To those who are new to the concept of DeFi yield farming and have been hearing it mentioned quite a lot lately but still do not know what it is yet, here it is again:

Yield Farming is essentially the act of users putting in their own funds to provide liquidity to the various DeFi protocols to “farm” the best “yield” which is in the form of native tokens for the respective protocol, thus earning additional capital.

The concept of Yield farming was accelerated by Compound and the distribution of their governance token — COMP. This new surge of interest led to more than $1Billion in new capital overflow in the protocol, with other lesser-known tokens like BAT seeing a jump of 20,000% in demand as traders moved to farm COMP.

Breaking Down what Yield Farming is

Yield: Returns or earnings generated and realized on a particular investment over a specific period of time, expressed in a percentage.

Farming in the case of yield farming is more like searching, harvesting, and cultivating.

Ok so let’s take a look at yield farming.

Numerous DEXs (decentralized exchanges)and protocols are always looking for liquidity providers, to ensure a functioning and flourishing enterprise.

If you lend out your digital assets and provide liquidity to one of these DEXs, in addition to what you gain on the amount you provide in terms of liquidity, you are rewarded with tokens. This is the yield you have earned, in the form of tokens, thus acquiring additional capital.

The farming part of the term refers to picking and choosing the best rates from the various protocols, and harvesting the yield based on your work.

This year an increasing focus has been on yield farming activities which are already a part of the DeFi ecosystem with projects like Compound, Synthetix, and Balancer.

COMP Yield Farming

Compound’s reward system has attracted the likes of many traders. Compound for the next 4 years will be rewarding a balanced allocation of its COMP token out of which 2880 are distributed daily. The attractiveness of the reward system has caught the eye of traders who have moved their assets into Compound to start Yield Farming COMP distributions. Other supportive projects like InstaDApp are helping COMP farming with its widget called ‘Maximize $COMP mining’ to enable users to get into this with just a click.

sUSD Yield Farming

Synthetix is a decentralized synthetic asset issuance protocol that is collateralized by the Synthetix Network token (SNX). Built on the Ethereum platform, the SNX tokens allow for the issuing of synthetic assets. In March, Synthetix initiated an incentives program for liquidity providers of sUSD which is the native stable coin of Synthetix. The campaign with a test period of 4-weeks, launched through the Curve and iearn exchange protocols, yearns to distribute 32,000 SNX tokens on a pro-rata basis to providers who stake their Curve LP tokens. This was an attractive prospect for yield farmers because you are earning interest on your stationary digital assets and liquid assets which can be sold off immediately.

BAL Yield Farming

Balancer, an automated market maker is a scalable protocol that allows its users to generate liquidity pools made of ERC-20 tokens. Balancer, in a bid to become fully decentralized, has launched its own liquidity campaign. BAL is the governance token of Balancer with 65 million sets aside for every 100 million BAL minting for the liquidity providers. At present 145,000 BAL are being distributed to liquidity providers every week attracting traders to park their funds in Balancer pools so that they can yield farm the BAL rewards.

Behind all this, Synthetix and Ren have created another Balancer pool for SNX and REN in which the liquidity rewards are distributed in the form of wrapped SNX and REN. The Balancer pool also will earn BAL tokens which would be redirected to the Curve BTC liquidity stakeholders. The Curve Liquidity provider tokens CRV could also be earned through the main BTC pool which also will be going back to liquidity providers. But both BAL and CRV are not on the open market yet and once they are available, they will be distributed on a pro-rata basis. Every week providers will get wrapped SNX & REN, BAL & CRV in tandem to their Curve BTC liquidity contributions.

Yield Farming 2020 and Onwards

Yield Farming has just started but the amount of opportunities it presents to traders to earn interest on their capital is never-ending. Its popularity is all set to skyrocket in a few months to come.

Yield Farming makes a lot of sense to users in the fact that:

1. Most all digital assets and tokens are kept on exchanges doing nothing when they could be earning interest.

2. The respective decentralized exchanges (DEXs) have spreads that are competitive and offer higher lending rates than centralized exchanges.

Yield farming is an attractive and exciting new development for both lenders and borrowers, and will definitely be getting more attention (a lot more) this year.

latestnews

PayPal Crypto Bound! PayPal is betting on bitcoin and DeFi in a BIG way.

PayPal is betting on bitcoin and DeFi in a big way. Here’s what you need to know.

PayPal shocked the financial world Monday, with rumors swirling of direct crypto sales to its 325 million customers along with its subsidiary Venmo. In a move that shook the crypto world, many pundits were taken back the news, as PayPal has a strong history of being a staunch opponent to crypto and DeFi.

PayPal’s core business is the facilitation of online payment service that allows both individuals and businesses to transfer funds with the help of electronic mode. It also is one of the first payment organizations to enable merchants to accept Bitcoin through Braintree with successful partnerships with payment processors like BitPay, GoCoin, and Coinbase. It also has integrated with Coinbase’s virtual currency wallet and exchange so that the users of Coinbase selling Bitcoin can withdraw the funds to their own PayPal accounts. Such alliances have helped PayPal build firm grounds and have provided it valuable market insights that will shape their future decisions.

PayPal also strongly believes that Blockchain technology holds immense potential especially in the world of finance. Its engagement with the broader Blockchain ecosystem until now demonstrates its increasing bent towards it.

PayPal & Crypto

In its list of firsts, PayPal is now looking at working with multiple cryptocurrency exchanges to source liquidity. Earlier PayPal was solely a means to withdraw funds from these exchanges but now it will for the first time proffer the direct sales of crypto. An industry source also opined that exchanges will not offer direct buy and sell of crypto from PayPal and Venmo with the likelihood that there will be in-built wallet functionality for storage.

While the entire industry is positively headed with the news, it could take a close to 3 months before this service is outlined for mainstream use. PayPal and its team have denied commenting on anything on their plans as of now. As per the industry predictions, Coinbase and Bitstamp are speculated to by the partners of PayPal in this initiative. Yet, no official comment from Bitstamp or CoinBase has been forthcoming on this matter.

PayPal & Coinbase

The history of PayPal and Coinbase goes back to 2016. Coinbase made instantaneous fiat withdrawals to PayPal in 2018, it also allowed European Coinbase users to withdraw to their PayPal accounts. Crypto is interestingly and increasingly being viewed as the most obvious way to reinforce and strengthen the user base on fintech apps and also generate new avenues for revenue generation.

More DeFi Competition

Square which was launched by Twitter CEO also launched bitcoin purchases in its own cash app in 2018. Its cash app reported an enormous Bitcoin revenue of $306 million as per the latest report. Revolut in partnership with Bitstamp also started offering crypto to users in 2017 and had raised a whopping $500 million in February.

PayPal CEO Dan Schulman has also made it evident that it will aggressively push on monetizing Venmo already besotted with 52 million accounts. While the PayPal CTO refused to comment on explicit plans of PayPal, he went on the record to confirm that the organizations believe strongly in the strong perspectives of the blockchain technology and its foray into the digitization of currency is now not a question of IF but rather WHEN.

PayPal’s Aggressive Recruitments

Earlier this year, PayPal also recruited a workforce to structure and strengthen its Blockchain research group. It also had eight open engineering positions in San Jose and Singapore. The different job openings with its descriptions are now live and public on the job board of the company. The opening for Technical Lead/ Crypto engineer will be responsible for all novel PayPal initiatives around the globe to lead the pack with innovation and agility. The technical lead will be required to design, develop, and maintain the crypto features so that it promises future availability, performance, and scalability.

PayPal is also seeking a blockchain research engineer that will be a part of the Strategic Technology Enablement team. The expert has to establish their opinions on emerging blockchain technologies and their uses with PayPal. These job listings bear resemblance to the fact that PayPal is getting aggressive and is trying to move deeper into the cryptocurrency market. The job requirements it has listed require several skills that coincide with Bitcoin development. For instance, as per their website, they need people with experience in C++, cryptographic libraries, and asymmetric cryptography.

Paypal & Technological Advancement

As of now, official comments and announcements are awaited, but the suggestions are strong enough to indicate that its foray will reverberate within the industry, sending shockwaves throughout the entire financial sector once officially announced.

Even though Elon Musk left PayPal long ago, one could argue PayPal is taking some lessons from his genius. With Tesla, Musk used his talent to predict a future where cars running on oil would be a thing of the past, betting big on rechargeable automobiles and renewable energy.

PayPal is now looking at DeFi and crypto, in the same manner, looking to get ahead of an inevitable reality: money will increasingly become digital. Will cars running on oil or physical money cease to exist? Not for some time, but during the transition period, both Tesla and PayPal are looking to capitalize on a huge market share in a potential multi-trillion dollar industry.

Check back in at DeFiRev.com to find out the latest in DeFi News.

latestnews

What is DeFi? Decentralized Finance explained.

What is DeFi?

DeFi is short for decentralized finance and refers to an all-inclusive ecosystem of applications, financial services, and other financial infrastructures that operate within the key principles of privacy, transparency, neutrality, and sovereignty. DeFi tools are openly accessible and operate utilizing blockchain technology, and it will be a game-changer for the financial world and the global economy as we know it.

Decentralized finance includes a wide spectrum including digital assets, smart contracts, dApps which are built on blockchain technology. Considering the amount of development and flexibility involved, the Ethereum platform is currently the foremost choice for DeFi applications; however, it is not the only one.

Imagine an open financial system in which financial tools and services can be built in a decentralized manner. Since these applications are always built utilizing blockchain technology, the data can easily be verified.

With the use of decentralized technology like smart contracts, DeFi has led to the elimination of middlemen, which have long plagued finance unnecessarily. This has created favorable situations where:

- One can get access to instant loans without the need for paperwork sans any bank approval.

- One can earn real interest with their assets without the need to sacrifice them due to the prevailing low-interest rates.

- Quick issuance of company stocks without the need for banks to intervene thereby saving one from exorbitant bank fees.

History of Bitcoin & DeFi

DeFi, or decentralized finance, originated from blockchain technology.

Bitcoin, which most people have at least heard of by now, was the forefather of Defi. Bitcoin was created by an individual or a team of individuals under the pseudonym of Satoshi Nakamoto in 2009 as a peer to peer electronic cash system. Peer to peer in this instance meaning that individuals can transact with one another directly, user to user, without a trusted third party.

Bitcoin was created in response to the bank bailouts after the 2008 financial crisis and a time where major banks were accused of rampant fraudulent activities. It emerged like the phoenix out of the ashes and provided hope for a new way of life that many citizens of this world so longed for. This innovative and exciting notion laid the foundation of a decentralized, censorship-resistant, and open and transparent platform, with the intent of replacing or strengthening the traditional system of value exchange.

The emergence of DeFi

Bitcoin is the first major and successful public blockchain and it is still the most popular and largest in terms of market capitalization. Yet over ten years after its invention, thousands of projects have been rolled out under the same guiding principles of decentralization. Bitcoin being open-source has allowed developers around the world to contribute to the community and create similar projects. The new currencies that emerged after, based on either blockchain or similar technologies, are known as cryptocurrencies that thrive on the ideologies of DeFi.

Consider the situation of a laborer who doesn’t own any bank account who has his daughter working in the US. Under the current remittance system, the fee alone overcharges the funds she sends by 7%. This apart, the laborer has no access to financial markets for making any investments. Inflation can eat away at his income over time, as he is unable to earn any interest over it.

DeFi enters the building.

Today, with the implementation of DeFi, the laborer can not only enjoy a larger portion of the funds due to lower fees, but an app on his smartphone allows him to invest a certain amount to generate a return on his savings.

The top financial leaders of the country have been holding on to their indomitable positions for long. But with glaring inequalities of these global financial systems in the wake of economic meltdowns, the dominance of the traditional financial system is waning.

With this pattern emerging in almost every region of the world, many crypto startups have risen like a phoenix with divergent sets of ideas, and with one principal intention: to ensure that financial services are accessible to everyone on a global scale. The adoption of Blockchain technology in finance is reshaping the existing ecosystem into a new world which is what we call Decentralized Finance or DeFi. With DeFi, not only finance is accessible to everyone, but it is also characterized by a relatively lower transaction price and security.

Let’s take a closer look a how DeFi measures up with traditional finance.

How DeFi scores over Traditional Finance

The best part about DeFi is the autonomy, which will in the coming years overthrow the central control exercised by governments and larger enterprises. DeFi certainly scores over Traditional finance, we tell you how:

- Irrespective of who creates, administers, and manages any DeFi service, there is complete transparency in its operations.

- Users have 100% control and access to their money. Custody is not in the hands of any financial institution like a bank.

- There are no geographical boundaries restructuring you, neither is there a dependence on verifying, again and again, your identity to manage digital assets. For those 1.7 million unbanked people, DeFi facilitates access to money with absolute control of money by its users.

- At the center of its operations, DeFi is not controlled by any institutions. The major role played is by the algorithms which are written in code or through smart contracts. After deploying smart contract DeFi apps can run without any human intervention.

- Lastly, DeFi comes with the power of code transparency making it possible for anyone to audit. This develops trust and the transactions being pseudonymous, questions about privacy are unlikely to emerge.

Many have pointed out that DeFi is just another form of ‘Open Finance’ which has been a matter of debate ever since it came into being.

The benefits of DeFi

In the quest to shape the global financial system, DeFi offers myriad benefits.

- DeFi is a disruptive concept that aims to tear apart the concept of status wealth. It enables wider global access to financial services. It intends to eliminate the barriers that prevent global access to financial instruments.

- The cross border payments are affordable because the role of intermediaries has been eviscerated.

- There is little doubt that DeFi provides superior security and unmeasured privacy. Centralized institutions are vulnerable to breaches. DeFi does not have any single centralized source of failure for any breaches to occur.

- Decentralized Finance also offers censorship-resistant transactions. The DeFi system brings the required stability and is a pefect option for those countries which are reeling under the rule of corrupt governments and leaders.

- In terms of becoming more mainstream, developers of DeFi applications are incessantly focussing on creating a seamless, integrated, transparent, and intuitive user experiences so that the full advantages of DeFi can become apparent to the mass general pubic

While each of the benefits is powerful in their own right, a combination of these can bring profound implications.

The Future of Decentralized Finance

DeFi is powered to change the world economy. It will enable the unbanked to join the rest of the world and become a part of the economic system thereby accelerating new investment opportunities. All the challenging areas in the financial system like loans and remittance is easily addressed by DeFi.

By removing inaccuracies, middlemen, and centralized control, DeFi is without a doubt the future of the entire financial sector and will transform the global economy.

DeFiRev.com is #1 in DeFi News. Check back in soon to find out the latest in DeFi News.

Make sure to check out more DeFiRev articles and sign up for our exclusive newsletter + get access to VIP DeFi Networking here.

DeFiRev.com – HOME

DeFiRev.com – DeFi Market Watch

latestnews

Coinbase IPO looking to be the first of its kind, setting its sights on an Initial Public Offering in 2020.

Coinbase is planning to make a grand entry in the space of publicly listed companies soon in the United States. Coinbase, the most celebrated start-up in the crypto universe, is all set to launch its IPO if it gets the final nod of approval from SEC. Launching an IPO would cement Coinbase’s foundation as well as re-establish the lawfulness of cryptocurrencies worldwide.

Coinbase’s decision to go public comes along the footsteps of Palantir, a data-focused firm which has also filed for an IPO almost in a clandestine manner. It was a Reuters report that propagated the likelihood of Coinbase making its public debut later this year or early 2021. According to the report, Coinbase has started working around the basics by recruiting investment banks and law firms to draw up formalities.

The whole world is watching to see if the Coinbase IPO will actually happen, but many industry analysts predict that it will occur something in late 2020 of this year.

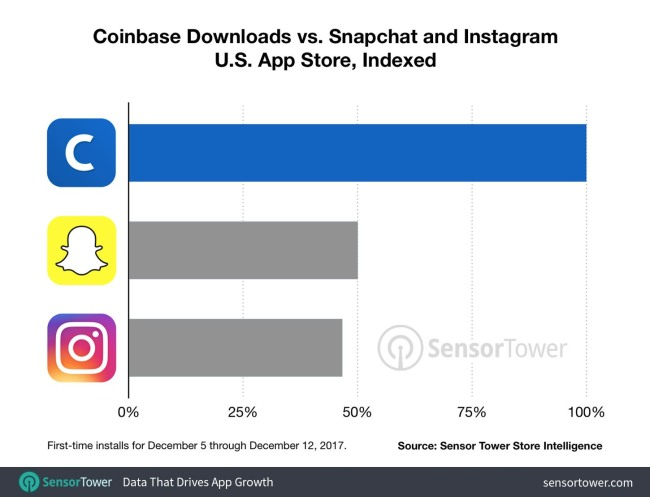

Coinbase is valued at $8 billion and is one of the most pursued ventures in the cryptoscape. A Coinbase IPO would mean several things to the industry. We see the listing of this North American key player as a boost in public perception towards cryptocurrencies. We have already seen that cryptos have been looked down upon as an extremely volatile investment option, especially in a decentralized format. But it has not lost its hope in becoming a preferable option for placing funds vis-a-vis traditional, centralized financial marketplace. Coinbase’s popularity also shows no signs of slowing down because the brand Coinbase has registered more downloads compared to entertainment apps like Snapchat.

Source: Sensortower

Coinbase already boasts of some mind-boggling numbers drawn from its official website.

But market correctors like the SEC have always tried to suppress Bitcoin as a replacement citing the alleged risks associated with it. Even in the case of a Coinbase IPO, the only conspicuous obstacle to its materializing is the SEC. Yet for most of us, getting scared of investing in cryptocurrencies is water under the bridge in today’s day in age, now that people are more informed and educated.

Did you know that a post about Bitcoin appears every 3 seconds on social media? Yes! That’s how curiosity and popularity are setting in.

Some interesting crypto statistics

- As of March 2020, there are 5,201 crypto assets and if you try to compare this figure with ancient history, you can see the difference!

- Cryptomarket’s total market capitalization as on March 15th stands at $155 billion and we all know it is huge.

- Blockchain start-ups have to date raised over $31 billion!

- Coinbase is considered the most popular crypto trading app with more than 30 million users.

If these figures aren’t convincing enough then nothing is!

If Coinbase is sanctioned for its IPO bid, it is an indirect indication that SEC has given its nod about its acceptance of the giant’s clout in the crypto industry as well as the potential of the crypto world to be a game-changer.

If sources and reports from the New York Times are believed Coinbase might just take the direct listing route instead of a traditional IPO. This would mean that investors and employees can sell off their existing stake in Coinbase to the public instead of the company issuing new shares. Over the years, direct listing has become popular because it helps private companies raise funds for their future growth in a less obstructive manner. Also, the case of the underpricing of IPOs is calling off many deals on the table.

What a Coinbase IPO would mean for the crypto and DeFi community

For a company like Coinbase which already floats comfortably on rich reserves, a direct listing makes sense. It has already raised about $500 million as a private company in addition to its recent dealings of private financing valued of $300 million valued at $8 billion.

Coinbase is big and the best in the business. Its financials seem healthy with 2017 revenues pinned at around $1 billion because of the hype surrounding cryptocurrencies. But being a private company, its financial years for the next two consequent years remain a mystery.

As avid watchers of this space, we can patiently wait for its S-1 filing which will enable the investors to have a good look at the company’s performance over the years, raw financial figures, and its journey amidst the different phases of cryptocurrency existence.

We are witnessing several other tech start-ups and noted companies taking the public IPO route but it is only with time that we will know how many fared well and how many fell flat.

-

trading1 year ago

trading1 year agoBittensor booms as Chip Mania hits Stock Market: The AI Race and the Potential of TAO

-

latestnews1 year ago

latestnews1 year agoPayPal Crypto Bound! PayPal is betting on bitcoin and DeFi in a BIG way.

-

trading1 year ago

trading1 year agoInjective Protocol, the new Binance IEO, packs a punch

-

trading1 year ago

trading1 year agoUniSwap Heating up BIG TIME! Is this the end of IEOs? New DeFi Projects fundraising on Uniswap.

-

interviews1 year ago

interviews1 year agoBobby Ong CoinGecko CEO: Interview with the Trailblazing Entrepreneur

-

latestnews1 year ago

latestnews1 year agoWhat is DeFi? Decentralized Finance explained.

-

trading1 year ago

trading1 year agoAAVE CRYPTO ASSET SOARING

-

Uncategorized1 year ago

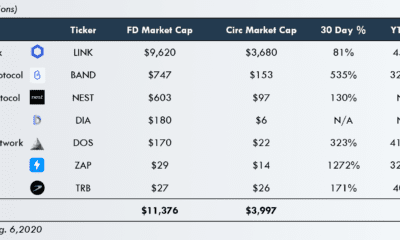

Uncategorized1 year agoDeFi Oracle Coins are hot hot hot this weekend. Chainlink, BAND, DIA, UMA, and others making major moves.