news

DeFi Oracle Coins are hot hot hot this weekend. Chainlink, BAND, DIA, UMA, and others making major moves.

Oracle solutions: a trending disruption in DeFi. Trend Signals major interest among investors and institutions.

Within the space of DeFi is another niche that calls for attention are Oracle tokens that are having a great 2020. Needless to say, DeFi has created the right kind of noise to trigger investment interest in these DeFi Oracles. In this article, we highlight the top-performing DeFi Oracle Coins.

So what exactly are oracles?

Oracles are nothing but services that are developed to integrate with smart contracts offering a mountain of real-time in-depth information on pricing. If the concept of oracle is being understood without any ambiguity its role can solve a major issue of data reliability in trading and several other applications of blockchain technology.

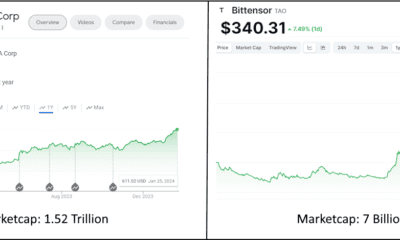

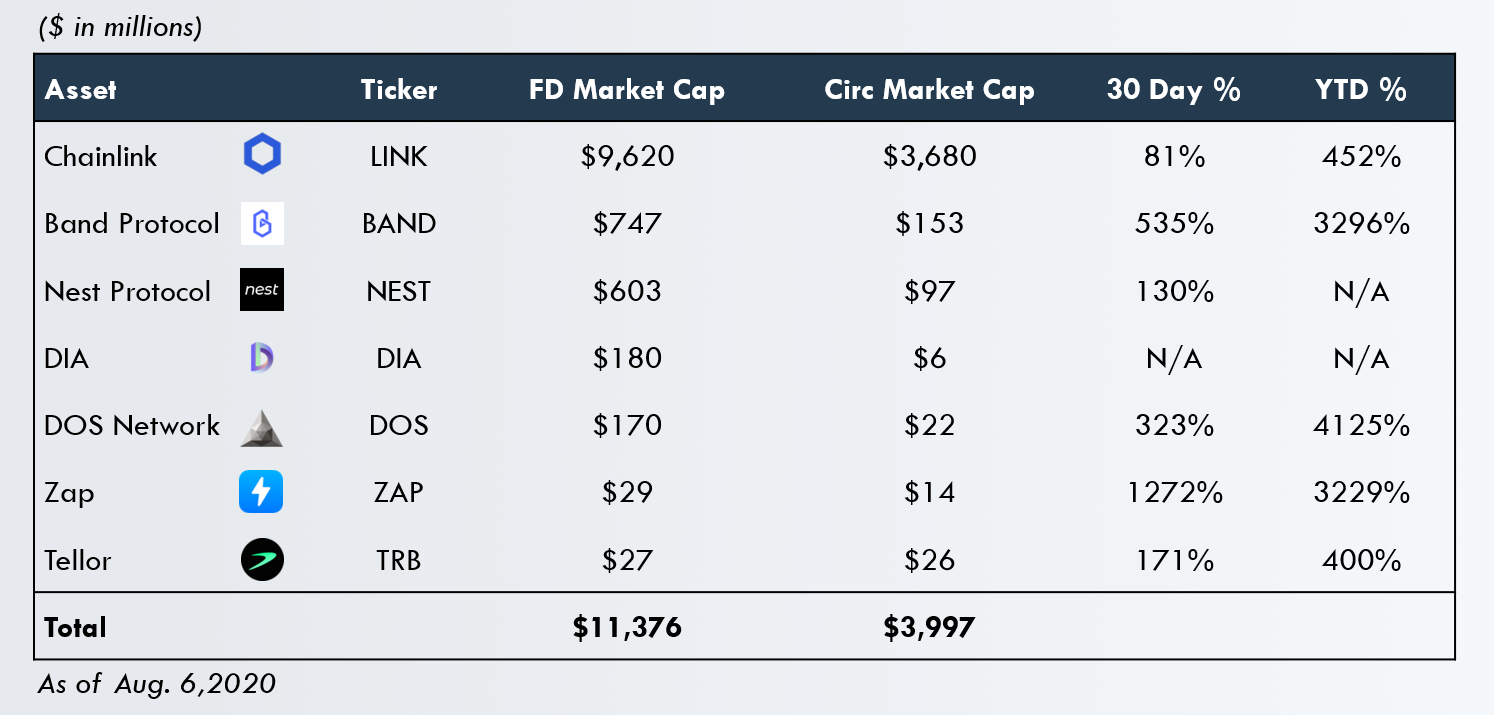

Messari, a known crypto data firm, had reported that amongst the crypto assets, ChainLink (LINK), Band, and Nest are among the highest performing this year. Chainlink and Band are particularly the top performers with maximum employability in different DeFi protocols. Their tokens rank among the most valuable DeFi tokens in another study by CoinGecko:

Top Performing DeFi Oracle Coins / Tokens

LINK

Its open-source API helps the developers to build multi-functional software and web applications to improve the performance in the crypto market. ChainLink has always worked towards increasing the adoption of digital currencies all across the world

- It’s On-chain as well as Off-chain design has been structured so as to help even the novices in the space and experts to invest more.

- The agreement so reached by the traders is kept confidential and the network ensures that there is no fraudulent activity

BAND

The Band Protocol is a decentralized Oracle framework mainly used for blockchain Decentralized apps. The Dapps are administered by Smart Contracts which feed these apps off-chain real-time data from trusted data providers. Band Protocol was backed by Sequoia Capital and Binance.

- The successful adoption of the Band protocol is due to the efforts of a great team from enriching experience who are dedicated to building a framework for decentralized data governance taking advantage of decentralization.

- The protocol prioritizes decentralization. Its internal team is crystal clear that it will not allow one entity to take control over even an iota of data

- Data provided are distributed perfectly because the protocol is community-driven, allowing people to build what they want to.

DIA

Decentralized Information Asset or DIA is an open-source information platform that makes use of crypto-economic incentives to source and validate data. DIA is a Swiss-based non-profit organization that operates with a mission to liberate financial data. The company culture promotes transparency in terms of sourcing data and makes it publicly accessible. DIA utilizes crypto-economic incentives for its stakeholders for data validation.

- Different DeFi platforms like Ampleforth, MakerDAO, etc are exposed to Oracle vulnerability. Their dependency on Price oracles is unquestionable which is where the role of DIA is strong as it has proven its worth in serving the needs of these platforms.

- Entities involved in trading are strongly benefitted in DIA’s open-source and trustworthy data. Its content including crypto data and financial news are backed with reliable sites and other new machinery.

UMA

UMA leverages the use of blockchain technology to encourage universal access with its digital-first approach. Universal Market Access or UMA is a protocol for the creation, maintenance, and settlement of derivatives for underlying assets. It allows users to create smart contract-based meta tokens by which traders can express their market view without the need to hold the tokens.

- Focused primarily on priceless derivatives on Ethereum, the contracts are designed in a manner to ensure collateralization without the need for on-chain price feed.

- Its DVM design ensures that any on-chain oracle can be compromised for a price. But UMA’s DVM is based on a system of economic incentives which ensures that there is no way to corrupt the DVM

TRB

Tellor or TRB are Ethereum-based decentralized oracles that are easily implementable through DeFi Dapps. Its data feeds are reliable as they use staked miners competing through Proof of Work to submit the official value.

- The Oracle is an on-chain data bank where data points are added and in return, the miners are given rewards called Tributes or TRB.

- It ensures a secure and sustainable system by incentivizing miners required for dispute resolution.

Oracles serve as the fundamental components to any stablecoin’s primary functionality which then feeds data to smart contracts in the most reliable and secure manner.

Thanks for reading about DeFi Oracle Coins!

DeFiRev.com is #1 in DeFi News. Check back in soon to find out the latest in DeFi News.

news

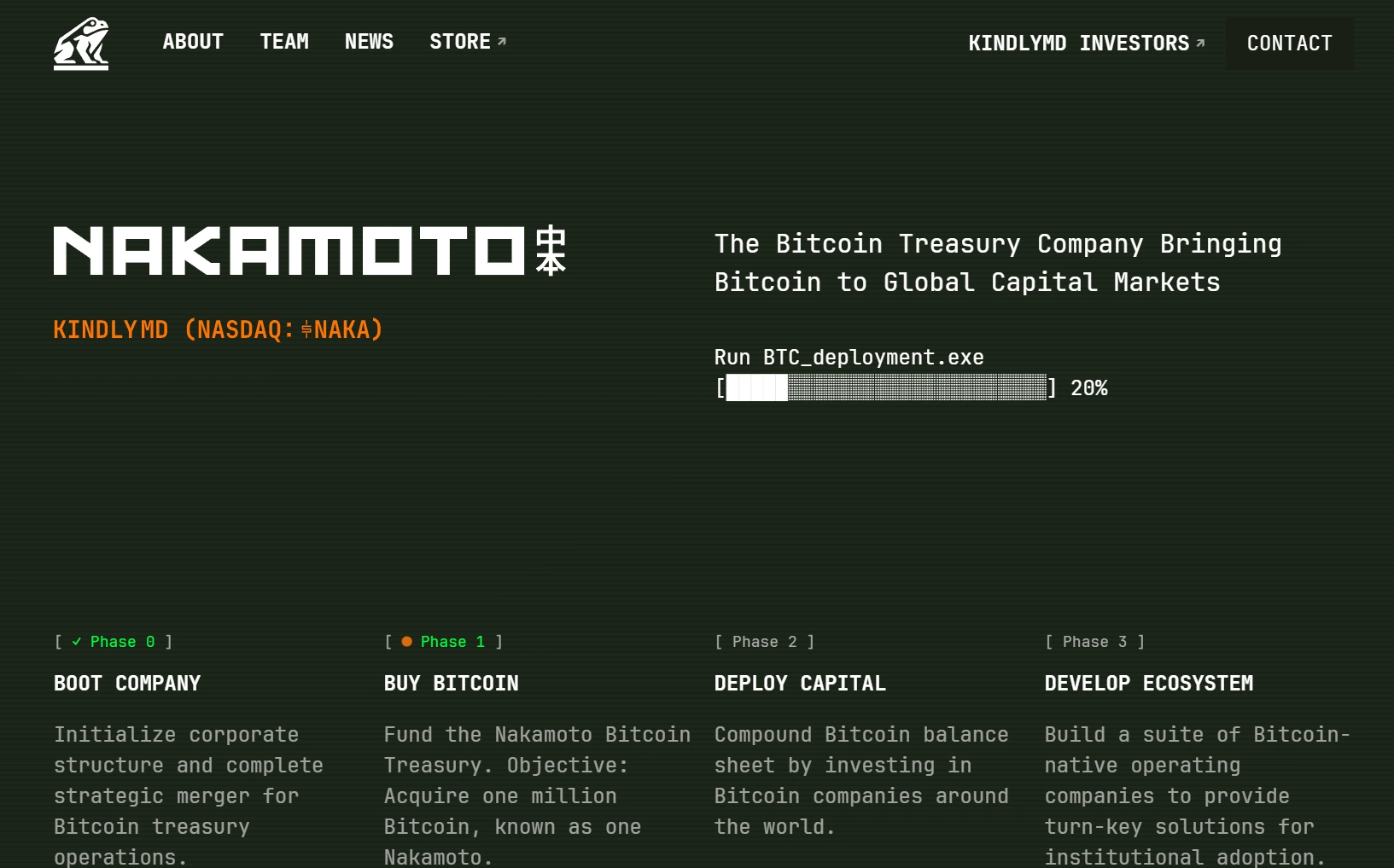

David Bailey’s Nakamoto creates Bitcoin Treasury with KindlyMD

David Bailey’s Bitcoin Treasury comes to life

On August 14, 2025, KindlyMD, Inc. (NASDAQ: NAKA) finalized its merger with Nakamoto Holdings Inc., a Bitcoin-native holding company, marking a bold step toward establishing a publicly traded Bitcoin treasury vehicle. The combined entity, retaining the KindlyMD name, will trade on the Nasdaq Capital Market under the ticker “NAKA,” with Nakamoto operating as a wholly-owned subsidiary focused on Bitcoin financial services. The merger, backed by $540 million in private placement (PIPE) financing and an anticipated $200 million convertible note offering, aims to fund significant Bitcoin acquisitions and drive global adoption.

David Bailey, Nakamoto’s founder and the combined company’s CEO, envisions a future where Bitcoin anchors global capital markets. “Since my journey in Bitcoin began 13 years ago, I’ve believed it will become the most valuable asset in history,” Bailey stated. The company’s ambitious goal is to acquire one million Bitcoin, leveraging innovative financial strategies to integrate the cryptocurrency into corporate and government treasuries.Bailey revealed his plan in a post on X (formerly Twitter) on Monday, writing:

$762M Allocation to Acquire 6,400 BTC

The $762.5 million allocation, rounded up in Bailey’s statement, will be used to acquire roughly 6,400 BTC at current market prices of about $118,892 per coin. The purchase will be executed using a Volume Weighted Average Price (VWAP) strategy to minimize slippage and avoid market disruption, rather than a straight market buy.

Building a $1B Bitcoin Treasury

This move is part of Bailey’s broader $1 billion Bitcoin accumulation goal, allowing Nakamoto to join the ranks of major corporate holders like MicroStrategy and Metaplanet. Following its merger with Nasdaq-listed KindlyMD earlier this year, Nakamoto has gained access to significant capital resources, having previously secured $710 million to fuel its Bitcoin treasury expansion.

Expanding Influence in the Bitcoin Space

Bailey, who also co-founded Bitcoin Magazine’s parent company BTC Inc., has described his vision as building a “Bitcoin juggernaut” that will become one of the largest holders in the world. He also took to X recently to signal his plans to raise up to $200 million for a political action committee to advance Bitcoin’s interests in the United States.

Corporate Bitcoin Holdings Continue to Rise

Nakamoto’s purchase comes amid a surge in corporate Bitcoin acquisitions, with over 1.24 million BTC now held by public and private companies worldwide, showing Bitcoin’s growing presence in institutional portfolios.

news

Coinbase DEX launches for the first time ever

Coinbase DEX has rolled out decentralized exchange (DEX) trading directly inside its app, giving users access to millions of onchain assets without leaving the platform. The launch is live for U.S. users outside New York State and runs on Coinbase’s Ethereum Layer 2 network, Base.

The feature introduces an integrated self-custody wallet, letting traders buy, sell, and manage tokens from the same interface they already use. Moreover, Coinbase is covering all network fees at launch, removing one of the main barriers to decentralized trading.

Faster Access to Onchain Markets

With the new Coinbase DEX integration, users can trade tokens within moments of their creation on Base. The initial rollout includes Base-native assets from projects like Virtuals AI Agents, Reserve Protocol DTFs, SoSo Value Indices, Auki Labs, and Super Champs. Support for new assets will be added in batches to maintain stable performance.

Trades are routed through Coinbase DEX aggregators that scan platforms like Aerodrome and Uniswap to secure the best available prices. Market data and risk insights are pulled directly from onchain sources, with Coinbase blocking access to tokens flagged as malicious by third-party security partners.

“A new era of access, going from just 300 assets yesterday to millions before long.” -Coinbase

Expansion Beyond Base

Coinbase plans to expand DEX trading to more networks, starting with Solana, and eventually to more countries. This move combines centralized convenience with decentralized freedom, offering portfolio management, fiat integration, and instant access to emerging tokens.

The company is positioning the update as part of its “everything exchange” vision, aiming to merge traditional listings with rapid onchain access. For traders and builders, this could mean faster entry to markets and a larger audience from day one.

news

Circle to Launch ARC Layer 1

USDC issuer Circle has announced plans to launch its own open Layer-1 blockchain, Arc, later this year. The network is designed specifically for stablecoin payments, foreign exchange, and capital markets, a move the company calls “the next era of stablecoin-native applications.” The announcement was made on August 12 through Circle’s official blog and X post:

Arc will be EVM-compatible and use USDC as its native gas token. This allows users to pay predictable, dollar-denominated transaction fees without holding volatile crypto assets. Other features include a built-in FX engine, deterministic sub-second settlement finality, and opt-in privacy controls.

Circle says Arc will be fully integrated across its platform and remain interoperable with the 24 blockchains already supporting USDC. The blockchain will run on Malachite, a high-performance consensus engine acquired from Informal Systems, and its core software will be released under an open-source license.

Based on their announcement, use cases for Arc range from cross-border payments and stablecoin FX markets to tokenized assets and on-chain credit systems. Circle aims to give developers and institutions a unified foundation to build stablecoin-powered applications at scale.

Arc will enter private testnet in the coming weeks, with a public testnet expected this fall and mainnet beta in 2026. As Circle put it, Arc is intended to be “the home for all forms of digital money and tokenized value,” bridging enterprise needs with the openness of public blockchain infrastructure.

-

trading2 years ago

trading2 years agoBittensor booms as Chip Mania hits Stock Market: The AI Race and the Potential of TAO

-

news2 years ago

news2 years agoPayPal Crypto Bound! PayPal is betting on bitcoin and DeFi in a BIG way.

-

trading2 years ago

trading2 years agoInjective Protocol, the new Binance IEO, packs a punch

-

trading2 years ago

trading2 years agoUniSwap Heating up BIG TIME! Is this the end of IEOs? New DeFi Projects fundraising on Uniswap.

-

trading5 years ago

trading5 years agoWhat is Solana? How SOL is aiming to solve scaling issues.

-

interviews2 years ago

interviews2 years agoBobby Ong CoinGecko CEO: Interview with the Trailblazing Entrepreneur

-

trading2 years ago

trading2 years agoAAVE CRYPTO ASSET SOARING

-

trading2 years ago

trading2 years agoEthereum 2.0 Launch: Staking, Launch Date, and More. Here’s everything you need to know.