latestnews

CRV Token Launch! Curve Finance Token launched after questionable start.

Amidst the frenzy, CRV Token is launched after a shaky start, some questions from the DeFi community have arisen.

The popular Decentralized finance project Curve was forced to launch its governance token CRV too soon thanks to an anonymous developer’s deployment of the contract without even the team knowing about it. The developers used a new account on Twitter and tweeted that he believed that the contracts were ready and went leap-frogging!

Source: Twitter

The Curve team in its preliminary response has confirmed that it is doubly verifying contracts and deployment benchmarks.

CRV Token Launch

After 7 hours of frantic confusion, research and brain-storming, the Curve team finally announced on Telegram and Discord that all was well, verified, and legitimate. It clarified on the record that the contracts have been thoroughly verified by the team to ensure that the correct deployment process has been followed. Curve DAO had been deployed by a community member and since the token/DAO received traction, they had no choice but to adopt it. The team has also assured that the anonymous users have been renounced of any admin powers.

The curve team went to further imply that they were skeptical initially and did the right checks. But, after the investigation, the deployment was completed with the correct code, admin keys, and data leaving them with no choice but accepting it and pushing forward the launch despite the official UI not ready!

So, August 14th marked the official launch of CRV opening the trading pair CRV/USDC on the decentralized trading platform Matcha. When the Curve was established, it did not achieve 100% decentralization which is what made them introduce its governance token CRV. With this Curve becomes a decentralized autonomous organization.

CurveDAO and Tokenomics

The new CurveDAO will allow CRV holders to decide on important developments by voting. Experienced CRV holders will have a better say and voting prioritization which will reduce the influence of wealthy holders.

The total supply of CRV is 3.03 billion with 1.3 billion marked as the circulating supply. CRV is being distributed by yield farming. Binance has also said that it will list CRV tokens soon enough when the deposits reach a sufficient level ensuring healthy market dynamics. Once the level is reached Binance will list CRV/BNB, CRV/BTC, CRV/BUSD & CRV/USDT trading pairs. Any further announcement will be made 30-minutes prior to the beginning of the trade.

The contracts were available on Github as they were open-source making its code accessible enabling the deployment on Ethereum. Curve operated under the assumption that this will not be a problem because no one would want to incur the deployment cost of more than $8000 in fees.

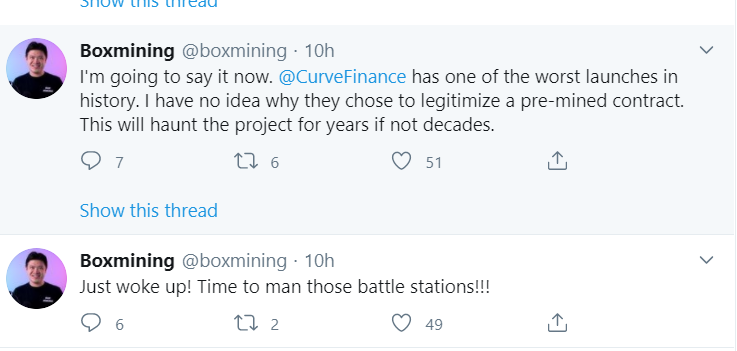

The community doesn’t seem too happy with several community members raising concerns about how fair the launch was. Popular influencer Boxmining was not too happy about it and expressed his concerns on his twitter handle.

Despite the contract being deployed, users, later on, discovered that the wallets had been staking and earning CRV tokens ahead of the official launch which the curve users believe does not look good and reflect unfair “pre-mine” practices.

A fixed number of CRV tokens get awarded in each block and when you are the only person who is competing for it, then that user gets all the tokens for the block. This led to 20,000 CRV tokens awarded to those who staked early before even the official announcement took place. In fact, one of the wallets even belonged to the developer who prematurely launched the token.

Curve Finance is one of the most sought after projects in DeFi but the launch was rocky considering its reputation. It took the developer 19.9 ETH to deploy the contract. Amidst the frantic activity, the project lead requested the users to wait until the due diligence was complete and until it receives an official green signal from Curve.

Now that the much-awaited CRV token has been launched, users who have provided liquidity to the protocol will be entitled to the token distributions retroactively. The release will bring a change in distributed governance managed through the curveDAO. The reward mechanism and CurveDAO were audited by the security firm Quantstamp.

Dune Analytics has cited that Curve has become one of the most popular decentralized exchange protocols in recent months dominating more than 20% of all DEX volume in June and July.

CRV Token Price

According to CoinGecko, the highest price the CRV token reached was $54.01 USD, while the lowest price was $9.64 USD.

The CRV token is currently trading at $12.20 USD as of 1:44 pm Pacific Standard Time on August 14th, 2020.

latestnews

PayPal Crypto Bound! PayPal is betting on bitcoin and DeFi in a BIG way.

PayPal is betting on bitcoin and DeFi in a big way. Here’s what you need to know.

PayPal shocked the financial world Monday, with rumors swirling of direct crypto sales to its 325 million customers along with its subsidiary Venmo. In a move that shook the crypto world, many pundits were taken back the news, as PayPal has a strong history of being a staunch opponent to crypto and DeFi.

PayPal’s core business is the facilitation of online payment service that allows both individuals and businesses to transfer funds with the help of electronic mode. It also is one of the first payment organizations to enable merchants to accept Bitcoin through Braintree with successful partnerships with payment processors like BitPay, GoCoin, and Coinbase. It also has integrated with Coinbase’s virtual currency wallet and exchange so that the users of Coinbase selling Bitcoin can withdraw the funds to their own PayPal accounts. Such alliances have helped PayPal build firm grounds and have provided it valuable market insights that will shape their future decisions.

PayPal also strongly believes that Blockchain technology holds immense potential especially in the world of finance. Its engagement with the broader Blockchain ecosystem until now demonstrates its increasing bent towards it.

PayPal & Crypto

In its list of firsts, PayPal is now looking at working with multiple cryptocurrency exchanges to source liquidity. Earlier PayPal was solely a means to withdraw funds from these exchanges but now it will for the first time proffer the direct sales of crypto. An industry source also opined that exchanges will not offer direct buy and sell of crypto from PayPal and Venmo with the likelihood that there will be in-built wallet functionality for storage.

While the entire industry is positively headed with the news, it could take a close to 3 months before this service is outlined for mainstream use. PayPal and its team have denied commenting on anything on their plans as of now. As per the industry predictions, Coinbase and Bitstamp are speculated to by the partners of PayPal in this initiative. Yet, no official comment from Bitstamp or CoinBase has been forthcoming on this matter.

PayPal & Coinbase

The history of PayPal and Coinbase goes back to 2016. Coinbase made instantaneous fiat withdrawals to PayPal in 2018, it also allowed European Coinbase users to withdraw to their PayPal accounts. Crypto is interestingly and increasingly being viewed as the most obvious way to reinforce and strengthen the user base on fintech apps and also generate new avenues for revenue generation.

More DeFi Competition

Square which was launched by Twitter CEO also launched bitcoin purchases in its own cash app in 2018. Its cash app reported an enormous Bitcoin revenue of $306 million as per the latest report. Revolut in partnership with Bitstamp also started offering crypto to users in 2017 and had raised a whopping $500 million in February.

PayPal CEO Dan Schulman has also made it evident that it will aggressively push on monetizing Venmo already besotted with 52 million accounts. While the PayPal CTO refused to comment on explicit plans of PayPal, he went on the record to confirm that the organizations believe strongly in the strong perspectives of the blockchain technology and its foray into the digitization of currency is now not a question of IF but rather WHEN.

PayPal’s Aggressive Recruitments

Earlier this year, PayPal also recruited a workforce to structure and strengthen its Blockchain research group. It also had eight open engineering positions in San Jose and Singapore. The different job openings with its descriptions are now live and public on the job board of the company. The opening for Technical Lead/ Crypto engineer will be responsible for all novel PayPal initiatives around the globe to lead the pack with innovation and agility. The technical lead will be required to design, develop, and maintain the crypto features so that it promises future availability, performance, and scalability.

PayPal is also seeking a blockchain research engineer that will be a part of the Strategic Technology Enablement team. The expert has to establish their opinions on emerging blockchain technologies and their uses with PayPal. These job listings bear resemblance to the fact that PayPal is getting aggressive and is trying to move deeper into the cryptocurrency market. The job requirements it has listed require several skills that coincide with Bitcoin development. For instance, as per their website, they need people with experience in C++, cryptographic libraries, and asymmetric cryptography.

Paypal & Technological Advancement

As of now, official comments and announcements are awaited, but the suggestions are strong enough to indicate that its foray will reverberate within the industry, sending shockwaves throughout the entire financial sector once officially announced.

Even though Elon Musk left PayPal long ago, one could argue PayPal is taking some lessons from his genius. With Tesla, Musk used his talent to predict a future where cars running on oil would be a thing of the past, betting big on rechargeable automobiles and renewable energy.

PayPal is now looking at DeFi and crypto, in the same manner, looking to get ahead of an inevitable reality: money will increasingly become digital. Will cars running on oil or physical money cease to exist? Not for some time, but during the transition period, both Tesla and PayPal are looking to capitalize on a huge market share in a potential multi-trillion dollar industry.

Check back in at DeFiRev.com to find out the latest in DeFi News.

latestnews

What is DeFi? Decentralized Finance explained.

What is DeFi?

DeFi is short for decentralized finance and refers to an all-inclusive ecosystem of applications, financial services, and other financial infrastructures that operate within the key principles of privacy, transparency, neutrality, and sovereignty. DeFi tools are openly accessible and operate utilizing blockchain technology, and it will be a game-changer for the financial world and the global economy as we know it.

Decentralized finance includes a wide spectrum including digital assets, smart contracts, dApps which are built on blockchain technology. Considering the amount of development and flexibility involved, the Ethereum platform is currently the foremost choice for DeFi applications; however, it is not the only one.

Imagine an open financial system in which financial tools and services can be built in a decentralized manner. Since these applications are always built utilizing blockchain technology, the data can easily be verified.

With the use of decentralized technology like smart contracts, DeFi has led to the elimination of middlemen, which have long plagued finance unnecessarily. This has created favorable situations where:

- One can get access to instant loans without the need for paperwork sans any bank approval.

- One can earn real interest with their assets without the need to sacrifice them due to the prevailing low-interest rates.

- Quick issuance of company stocks without the need for banks to intervene thereby saving one from exorbitant bank fees.

History of Bitcoin & DeFi

DeFi, or decentralized finance, originated from blockchain technology.

Bitcoin, which most people have at least heard of by now, was the forefather of Defi. Bitcoin was created by an individual or a team of individuals under the pseudonym of Satoshi Nakamoto in 2009 as a peer to peer electronic cash system. Peer to peer in this instance meaning that individuals can transact with one another directly, user to user, without a trusted third party.

Bitcoin was created in response to the bank bailouts after the 2008 financial crisis and a time where major banks were accused of rampant fraudulent activities. It emerged like the phoenix out of the ashes and provided hope for a new way of life that many citizens of this world so longed for. This innovative and exciting notion laid the foundation of a decentralized, censorship-resistant, and open and transparent platform, with the intent of replacing or strengthening the traditional system of value exchange.

The emergence of DeFi

Bitcoin is the first major and successful public blockchain and it is still the most popular and largest in terms of market capitalization. Yet over ten years after its invention, thousands of projects have been rolled out under the same guiding principles of decentralization. Bitcoin being open-source has allowed developers around the world to contribute to the community and create similar projects. The new currencies that emerged after, based on either blockchain or similar technologies, are known as cryptocurrencies that thrive on the ideologies of DeFi.

Consider the situation of a laborer who doesn’t own any bank account who has his daughter working in the US. Under the current remittance system, the fee alone overcharges the funds she sends by 7%. This apart, the laborer has no access to financial markets for making any investments. Inflation can eat away at his income over time, as he is unable to earn any interest over it.

DeFi enters the building.

Today, with the implementation of DeFi, the laborer can not only enjoy a larger portion of the funds due to lower fees, but an app on his smartphone allows him to invest a certain amount to generate a return on his savings.

The top financial leaders of the country have been holding on to their indomitable positions for long. But with glaring inequalities of these global financial systems in the wake of economic meltdowns, the dominance of the traditional financial system is waning.

With this pattern emerging in almost every region of the world, many crypto startups have risen like a phoenix with divergent sets of ideas, and with one principal intention: to ensure that financial services are accessible to everyone on a global scale. The adoption of Blockchain technology in finance is reshaping the existing ecosystem into a new world which is what we call Decentralized Finance or DeFi. With DeFi, not only finance is accessible to everyone, but it is also characterized by a relatively lower transaction price and security.

Let’s take a closer look a how DeFi measures up with traditional finance.

How DeFi scores over Traditional Finance

The best part about DeFi is the autonomy, which will in the coming years overthrow the central control exercised by governments and larger enterprises. DeFi certainly scores over Traditional finance, we tell you how:

- Irrespective of who creates, administers, and manages any DeFi service, there is complete transparency in its operations.

- Users have 100% control and access to their money. Custody is not in the hands of any financial institution like a bank.

- There are no geographical boundaries restructuring you, neither is there a dependence on verifying, again and again, your identity to manage digital assets. For those 1.7 million unbanked people, DeFi facilitates access to money with absolute control of money by its users.

- At the center of its operations, DeFi is not controlled by any institutions. The major role played is by the algorithms which are written in code or through smart contracts. After deploying smart contract DeFi apps can run without any human intervention.

- Lastly, DeFi comes with the power of code transparency making it possible for anyone to audit. This develops trust and the transactions being pseudonymous, questions about privacy are unlikely to emerge.

Many have pointed out that DeFi is just another form of ‘Open Finance’ which has been a matter of debate ever since it came into being.

The benefits of DeFi

In the quest to shape the global financial system, DeFi offers myriad benefits.

- DeFi is a disruptive concept that aims to tear apart the concept of status wealth. It enables wider global access to financial services. It intends to eliminate the barriers that prevent global access to financial instruments.

- The cross border payments are affordable because the role of intermediaries has been eviscerated.

- There is little doubt that DeFi provides superior security and unmeasured privacy. Centralized institutions are vulnerable to breaches. DeFi does not have any single centralized source of failure for any breaches to occur.

- Decentralized Finance also offers censorship-resistant transactions. The DeFi system brings the required stability and is a pefect option for those countries which are reeling under the rule of corrupt governments and leaders.

- In terms of becoming more mainstream, developers of DeFi applications are incessantly focussing on creating a seamless, integrated, transparent, and intuitive user experiences so that the full advantages of DeFi can become apparent to the mass general pubic

While each of the benefits is powerful in their own right, a combination of these can bring profound implications.

The Future of Decentralized Finance

DeFi is powered to change the world economy. It will enable the unbanked to join the rest of the world and become a part of the economic system thereby accelerating new investment opportunities. All the challenging areas in the financial system like loans and remittance is easily addressed by DeFi.

By removing inaccuracies, middlemen, and centralized control, DeFi is without a doubt the future of the entire financial sector and will transform the global economy.

DeFiRev.com is #1 in DeFi News. Check back in soon to find out the latest in DeFi News.

Make sure to check out more DeFiRev articles and sign up for our exclusive newsletter + get access to VIP DeFi Networking here.

DeFiRev.com – HOME

DeFiRev.com – DeFi Market Watch

latestnews

Coinbase IPO looking to be the first of its kind, setting its sights on an Initial Public Offering in 2020.

Coinbase is planning to make a grand entry in the space of publicly listed companies soon in the United States. Coinbase, the most celebrated start-up in the crypto universe, is all set to launch its IPO if it gets the final nod of approval from SEC. Launching an IPO would cement Coinbase’s foundation as well as re-establish the lawfulness of cryptocurrencies worldwide.

Coinbase’s decision to go public comes along the footsteps of Palantir, a data-focused firm which has also filed for an IPO almost in a clandestine manner. It was a Reuters report that propagated the likelihood of Coinbase making its public debut later this year or early 2021. According to the report, Coinbase has started working around the basics by recruiting investment banks and law firms to draw up formalities.

The whole world is watching to see if the Coinbase IPO will actually happen, but many industry analysts predict that it will occur something in late 2020 of this year.

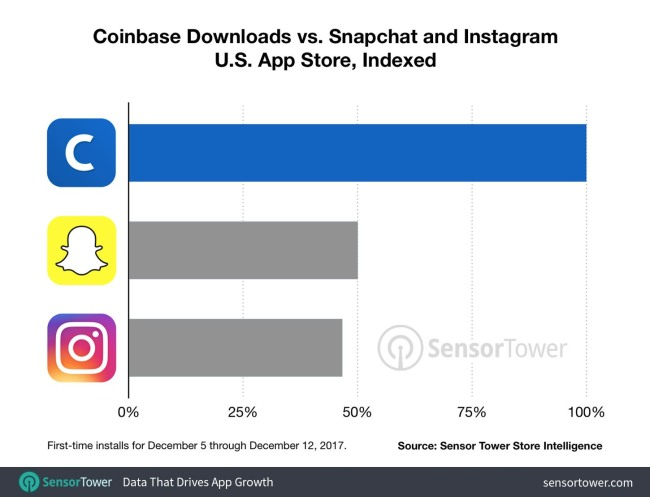

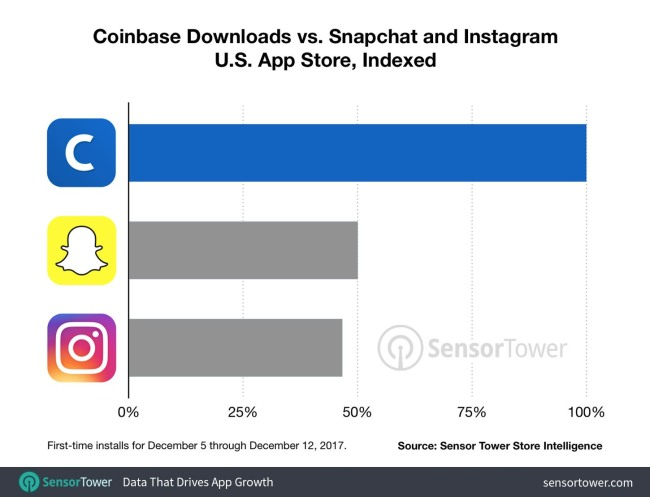

Coinbase is valued at $8 billion and is one of the most pursued ventures in the cryptoscape. A Coinbase IPO would mean several things to the industry. We see the listing of this North American key player as a boost in public perception towards cryptocurrencies. We have already seen that cryptos have been looked down upon as an extremely volatile investment option, especially in a decentralized format. But it has not lost its hope in becoming a preferable option for placing funds vis-a-vis traditional, centralized financial marketplace. Coinbase’s popularity also shows no signs of slowing down because the brand Coinbase has registered more downloads compared to entertainment apps like Snapchat.

Source: Sensortower

Coinbase already boasts of some mind-boggling numbers drawn from its official website.

But market correctors like the SEC have always tried to suppress Bitcoin as a replacement citing the alleged risks associated with it. Even in the case of a Coinbase IPO, the only conspicuous obstacle to its materializing is the SEC. Yet for most of us, getting scared of investing in cryptocurrencies is water under the bridge in today’s day in age, now that people are more informed and educated.

Did you know that a post about Bitcoin appears every 3 seconds on social media? Yes! That’s how curiosity and popularity are setting in.

Some interesting crypto statistics

- As of March 2020, there are 5,201 crypto assets and if you try to compare this figure with ancient history, you can see the difference!

- Cryptomarket’s total market capitalization as on March 15th stands at $155 billion and we all know it is huge.

- Blockchain start-ups have to date raised over $31 billion!

- Coinbase is considered the most popular crypto trading app with more than 30 million users.

If these figures aren’t convincing enough then nothing is!

If Coinbase is sanctioned for its IPO bid, it is an indirect indication that SEC has given its nod about its acceptance of the giant’s clout in the crypto industry as well as the potential of the crypto world to be a game-changer.

If sources and reports from the New York Times are believed Coinbase might just take the direct listing route instead of a traditional IPO. This would mean that investors and employees can sell off their existing stake in Coinbase to the public instead of the company issuing new shares. Over the years, direct listing has become popular because it helps private companies raise funds for their future growth in a less obstructive manner. Also, the case of the underpricing of IPOs is calling off many deals on the table.

What a Coinbase IPO would mean for the crypto and DeFi community

For a company like Coinbase which already floats comfortably on rich reserves, a direct listing makes sense. It has already raised about $500 million as a private company in addition to its recent dealings of private financing valued of $300 million valued at $8 billion.

Coinbase is big and the best in the business. Its financials seem healthy with 2017 revenues pinned at around $1 billion because of the hype surrounding cryptocurrencies. But being a private company, its financial years for the next two consequent years remain a mystery.

As avid watchers of this space, we can patiently wait for its S-1 filing which will enable the investors to have a good look at the company’s performance over the years, raw financial figures, and its journey amidst the different phases of cryptocurrency existence.

We are witnessing several other tech start-ups and noted companies taking the public IPO route but it is only with time that we will know how many fared well and how many fell flat.

-

trading1 year ago

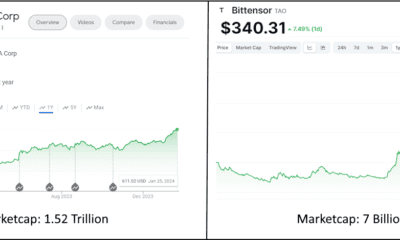

trading1 year agoBittensor booms as Chip Mania hits Stock Market: The AI Race and the Potential of TAO

-

latestnews1 year ago

latestnews1 year agoPayPal Crypto Bound! PayPal is betting on bitcoin and DeFi in a BIG way.

-

trading1 year ago

trading1 year agoInjective Protocol, the new Binance IEO, packs a punch

-

trading1 year ago

trading1 year agoUniSwap Heating up BIG TIME! Is this the end of IEOs? New DeFi Projects fundraising on Uniswap.

-

interviews1 year ago

interviews1 year agoBobby Ong CoinGecko CEO: Interview with the Trailblazing Entrepreneur

-

latestnews1 year ago

latestnews1 year agoWhat is DeFi? Decentralized Finance explained.

-

trading1 year ago

trading1 year agoAAVE CRYPTO ASSET SOARING

-

Uncategorized1 year ago

Uncategorized1 year agoWhat is Solana? How SOL is aiming to sovle scaling issues.